The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme in India aimed at securing the future of girl children. Launched in 2015 as a part of the Beti Bachao, Beti Padhao campaign, this scheme has been instrumental in promoting financial inclusion and empowering families to save for their daughters' education and marriage expenses. In recent times, the Sukanya Samriddhi Yojana has undergone some policy changes to further enhance its benefits. Let's delve into the new policy updates and understand how it can benefit families and contribute to the welfare of the girl child.

Increased Minimum Deposit:

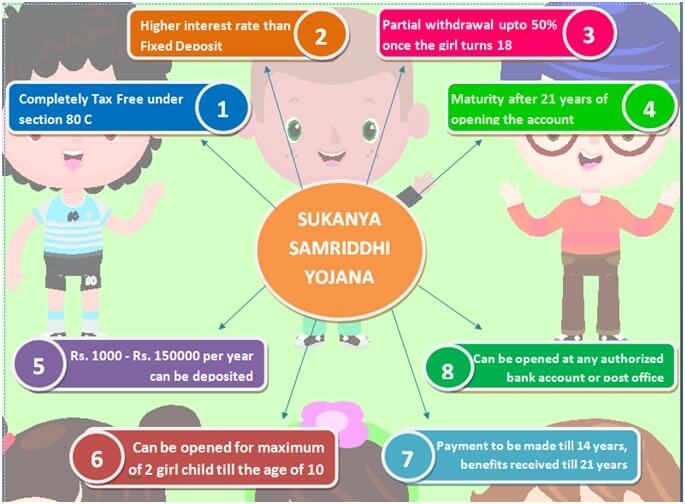

Under the new policy, the minimum deposit required to open a Sukanya Samriddhi Yojana account has been increased from Rs. 250 to Rs. 500. This revision encourages families to contribute a higher amount towards their daughters' savings, fostering a stronger financial foundation for their future.

Higher Maximum Deposit Limit:

The maximum deposit limit for the Sukanya Samriddhi Yojana account has also been increased. Previously capped at Rs. 1.5 lakh per financial year, the new policy allows deposits up to Rs. 2.5 lakh per year. This change enables families to save more for their daughters' education, marriage, and overall well-being.

Revised Interest Rates:

The Sukanya Samriddhi Yojana offers attractive interest rates, which are subject to periodic revisions. The new policy updates include revised interest rates to align with prevailing market conditions. It is important for potential investors to stay updated on the current rates to make informed decisions and maximize the returns on their investments.

Account Maturity Period:

The account maturity period under the Sukanya Samriddhi Yojana remains unchanged at 21 years from the date of opening the account. This policy ensures that the funds mature when the girl child reaches adulthood, providing financial support for higher education, career aspirations, or other life goals.

Tax Benefits:

One of the significant advantages of the Sukanya Samriddhi Yojana is the tax benefits it offers. Contributions made towards the scheme are eligible for deductions under Section 80C of the Income Tax Act, up to a specified limit. Additionally, the interest earned and the final maturity amount are tax-exempt. These tax benefits make the scheme even more attractive for individuals seeking to save for their daughters' future while minimizing their tax liability.

Flexibility and Withdrawals:

The Sukanya Samriddhi Yojana provides flexibility in terms of partial withdrawals. After the girl child turns 18 years old, partial withdrawals can be made for higher education or other specific purposes. This feature ensures that the funds can be utilized effectively to support the girl child's aspirations and needs at different stages of her life.

Conclusion:

The Sukanya Samriddhi Yojana's new policy updates offer enhanced benefits and opportunities for families to secure the financial future of their girl child. The increased minimum and maximum deposit limits, revised interest rates, tax benefits, and flexibility in withdrawals make the scheme a powerful tool for long-term savings and empowerment. By taking advantage of the Sukanya Samriddhi Yojana, families can contribute towards creating a brighter and more prosperous future for their daughters, ensuring their dreams are fulfilled and their potential is realized.